The allure of a barndominium, with its unique blend of rustic charm and modern living, has captured the imaginations of many homeowners seeking a distinctive dwelling. However, as with any dream home, the journey often involves the intricacies of financing. Fear not, for we’re here to guide you through the maze of financing options for your barndominium venture.

1. Understanding Barndominium Financing

Barndominium financing differs from traditional home financing due to the hybrid nature of these structures. Combining the functionality of a barn with the comfort of a home, barndominiums require lenders who understand this unique concept. Seek out financial institutions experienced in financing non-traditional homes to ensure a smoother process.

2. Exploring Construction Loans

Given that barndominiums are often custom-built, construction loans become a popular choice. These loans provide funds in stages throughout the construction process, allowing you to pay for materials and labor as needed. Once construction is complete, the loan can transition into a traditional mortgage.

3. Traditional Mortgages for Barndominiums

While not all lenders offer traditional mortgages for barndominiums, some do. It’s essential to shop around and find a lender willing to finance your unique property. Keep in mind that interest rates and terms may vary, so comparing multiple offers is key to securing the best deal.

4. Consideration of Personal Loans

For those not inclined towards traditional mortgages, personal loans can be an alternative. While interest rates might be higher, the flexibility and quicker approval process could make this option appealing, especially for smaller-scale barndominium projects.

5. Federal Housing Administration (FHA) Loans

FHA loans can be an option for financing your barndominium if it meets certain criteria. FHA-approved lenders may consider these structures, but compliance with FHA guidelines regarding safety and habitability is crucial.

6. Collaborating with Local Credit Unions

Local credit unions often have a more community-centric approach to lending. Some credit unions are more open to financing unconventional homes, including barndominiums. Establishing a relationship with your local credit union can open doors to personalized financing solutions.

7. Showcasing Your Vision to Lenders

When seeking financing, it’s crucial to present your barndominium project in the best light possible. Provide detailed plans, cost estimates, and any relevant documentation to demonstrate the feasibility and value of your venture. A well-prepared proposal can instill confidence in lenders and increase the likelihood of approval.

In conclusion, financing your barndominium dream involves a mix of research, creativity, and finding the right financial partner. As the popularity of these unique homes continues to rise, more lenders are becoming familiar with barndominium financing. Remember to explore all available options, compare terms, and choose the financing solution that aligns with your vision and financial goals. With the right approach, you’ll be on your way to turning your barndominium dream into a reality.

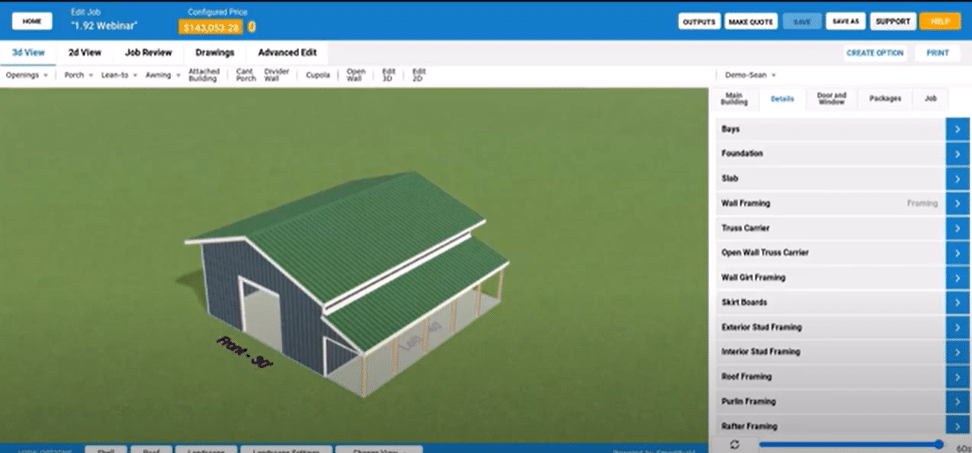

If you’re ready to design your barndominium NOW, click here to get your free trial of SmartBuild’s Interior Floor Plan Design System! SmartBuild’s new Interior Floor Plan Design System makes it easy to build more Barndos AND your bottom line!

Just like the original post frame software, SmartBuild’s interior floor layout tool features the familiar process of designing structures graphically on screen while automatically generating a 3D model, materials list, labor calculations, pricing, and a full set of drawings.

Streamline your sales process and attract more customers with SmartBuild Systems. Get your free trial today!